Are you Familiar With “Making the Lease fit the Prospect – The Big Picture?

A well-rounded petroleum landman should, as much as possible, be very familiar with the “Big Picture” as to the oil and gas project he is trying to lease. Sometimes that is impossible to do due to confidential information associated with the project. But when the landman can work with the geologist, general information can be useful in negotiating and structuring the oil and gas leases because most mineral owners look at the lease negotiations as a blanket response to any proposal. In other words, they have what I call the, “I want syndrome.”

Something to remember about negotiating Oil and Gas Leases is that if you are in a “hot area” where you have a lot of competition, the Mineral Owners generally have a good knowledge of what they can demand and between them and the competition and generally set the acceptable terms and price per acre they will be willing to take, because other are leasing under those terms and price (keep in mind you may have to educate them that your prospect is different than that which is going on around their Mineral Interest. For example, acquiring Leases in and around Midland, Texas.

Being able to negotiate in these areas can be somewhat of a challenge and may not yield the results you are hoping for. In such cases, you may just have to elect to take a business risk and take the Lease. But if you are in an area that has no competition it can be a completely different “ball game”. So, for this workshop, we are going to concentrate on such an area and bring into the mix a set of development issues that the Mineral Owner will or may not know, which will help you obtain the Lease you need and want to successfully develop your prospect.

This workshop was designed from an actual Lease negotiation in an area in Texas which had not been leased in over 20 years and no Horizontal Well had ever been drilled.

The previous wells were vertical shallow oil and gas wells and drilled by local oil companies.

These companies did not respect the Landowners’ land and left a “bad taste in the community’s mouth” about ever leasing again.

The land is rural land used for “hunting and recreation” and is worth (to buy) approximately $15,000 per acre.

The nearest large town is 20 miles away and the Leasehold sits on either side of a major state highway.

There are existing natural gas pipelines running across the Leasehold, however the service companies must come some distance to service the drilling and completion efforts.

Most of the Landowners are “wealthy absentee owners” who use the land for their “get away” recreational area (mainly hunting and fishing) and claim that the preservation of the land is more important than any oil or gas income.

All the Mineral/Landowners have hired a large law firm in Houston, Texas to represent them, so dealing with the Mineral/Landowners is only an initial effort to be able to see if there is any interest in moving forward.

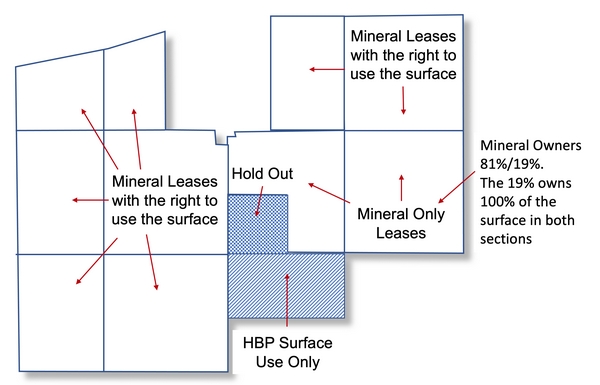

Another issue that since Texas does not have compulsory or Forced Pooling, the Voluntary Pooling Language in the Lease is an issue with these Mineral/Landowners and two of the main sections of Leases could end up as “Mineral Only Leases.”

Another key issue is the lack of numerous Gas Markets and initial Gas Pipeline Capacities along with potential Force Majeure delays regarding the availability of drilling rigs, workover rigs, and completion services.

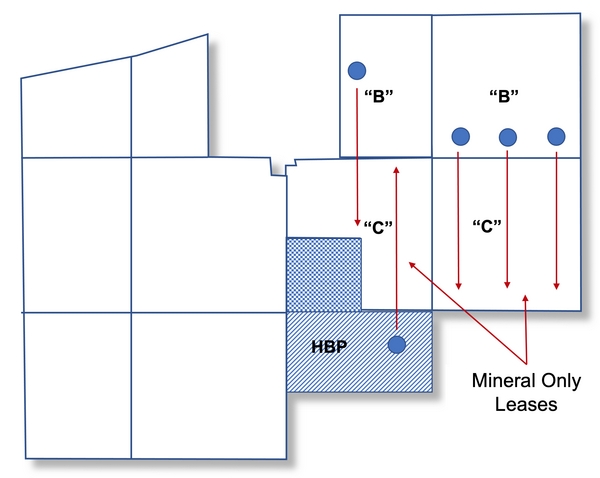

The prospect is a Horizontal ”infield” drilling prospect (no vertical wells) which is based on seismic interpretations of the orientation of the fractures. One large Drill Pad is needed on each section to accommodate several Horizontal Wells, which lowers the surface use impact.

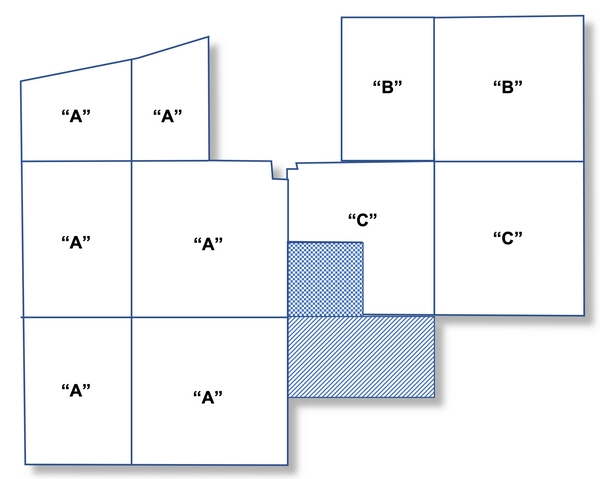

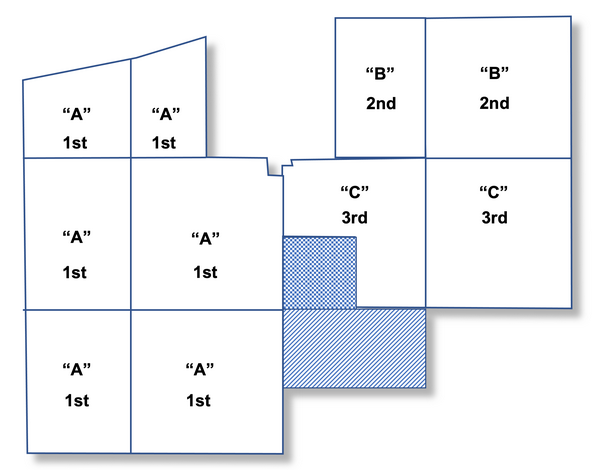

Six sections (“A” Tracts – see map) are Mineral/Landowners who have agreed to your Lease and Surface Damage and Use forms and terms and cover both the Minerals and Surface Use.

Two sections (“B” Tracts – see map) have initially rejected your Lease offer and Surface Damage and Use Agreement along with the Lease Bonus and Term that the Mineral/Landowner in the “A” Tracts agreed to. They would entertain leasing but using their Lease Form and their Surface Damage and Use Agreement.

Two sections (“C” Tracts – see map) have one Mineral Owner (who owns 100% of the surface) will not entertain leasing at all due to his land being set aside for Deer Hunting (a Mineral Only Leases may be an option) – this ownership is:

81% Minerals – 0% Surface

19% Minerals – 100% Surface

NOTE: The Mineral Owner owning the 81% of the minerals also owns 100% of the minerals and surface on the tracts covering the entire west side of the prospect and 100% of the minerals and surface of the HBP tract.

One 160-acre tract is not willing to lease if the Lease has a Pooling Clause that allows for Voluntary Pooling in a larger Horizontal Drilling Unit.

Another 320-acre tract is HBP (possible Farmout situation) but the Surface Owner is the Mineral Owner in the “A” Tracts who had agreed to lease and the use of the Surface.

Seismic will need to be conducted prior to drilling and operations will begin on the “A”Tracts. The ”B”Tracts will be good for Horizontal Drilling but also could serve as a Multi Horizontal Well Drill Pad for the Horizontal Legs going from those lands across the “CTracts in the event we were to obtain a “Mineral Only Lease” on them.

The 320-acre tract is only to use for access to the surface (tract is HBP) and given the fact that there is no sub-surface trespassing in the Texas, this site would be used for a Horizontal Drill Pad for drilling a Horizontal Well going back to the north under the “C”Tracts if we were able to acquire a Mineral Only Lease.

The leasing strategy was to initially obtain Leases on the “A”Tracts on the west side of the prospect first, then acquire the Lease and Surface Damage and Use Agreements under the “B”Tracts and then secure the rights to use the HBP surface tract to the south.

And finally obtain the Leases on the “C”Tracts.

Lease Area “A” – One Mineral Owner/One Surface Owner

Owns 81% of the minerals in Leasehold “C.”

Owns 100% of the minerals and surface of the HBP tract.

Lease Area “B” – One Mineral Owner/One Surface Owner

Owns 100% of the minerals and the surface,

Lease Area ”C” – Two Mineral Owners and One Surface Owner.

One Mineral Owner = 81% of the minerals (no surface).

One Mineral Owner = 19% of the minerals (100% of the surface).

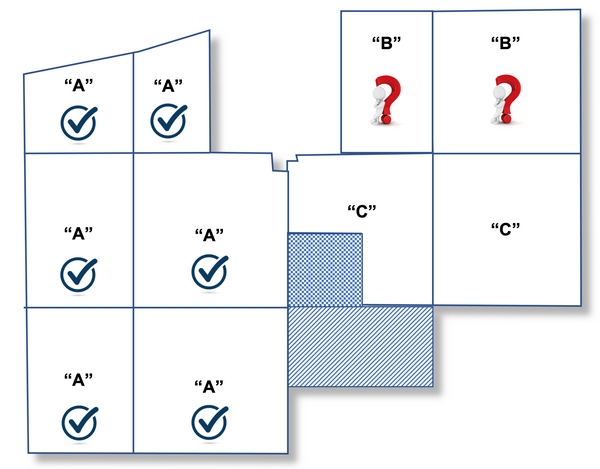

Initial Project Planning and Work – “A” Tracts

Title was run on all tracts on the “A” Tracts located on the west side of the prospect first.

No title issues.

The Mineral Owner/Landowner (100%) agreed to lease using our Lease Form.

Some special Surface Use Concessions were made to accommodate a “no drilling provision” during “deer hunting season.”

The Mineral Owner/Landowner agreed to allowing Seismic Operations to be conducted on the Surface and a separate agreement was entered.

The Mineral Owner/Landowner signed Oil and Gas Leases at $50 per acre, 3 1/6ths, 3-year Primary Term, 2-year option to extend at 125% of original bonus.

So far so good!

Initial Project Planning and Work – “B” Tracts

Title was run on the “B” Tracts and no title issues were found – One Mineral/Landowner.

Here is where the planning took a turn.

This Mineral Owner did not agree the terms used in Leases for the “A” Tracts and wanted to use his Lease Form (he was in the oil business) which was drafted by an Oil and Gas Law Firm in Houston, Texas.

In addition, he did not accept the Surface Damage and Use Agreement used in the “A” Tracts and wanted to use the Surface Damage and Use Form that is used on School Lands in Texas (this land was not School Lands).

NOTE: This School Land Agreement was not suitable to use in this prospect due to restrictions that would prohibit the timely development. Multiple attempts were made to negotiate the Lease and Surface Damage and Use Agreement, which makes up the discussion in this workshop.

An important note to remember is that these “B”Tract Leases were vital if the minerals under the “C”Tracts were to be developed if we had to accept a Mineral Only Lease.

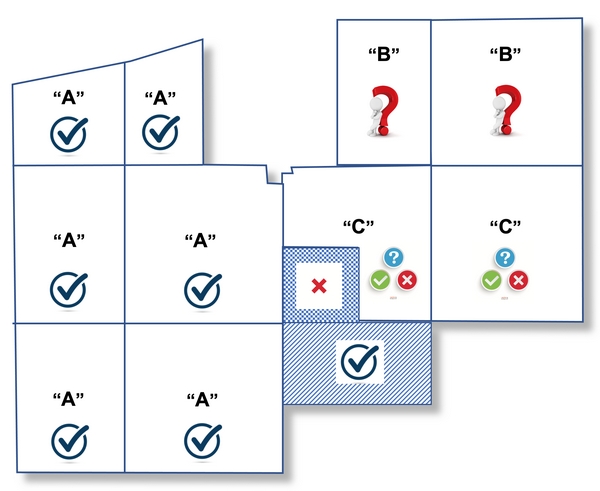

Initial Project Planning and Work – “C” Tracts

Title was run on the “C” Tracts and no title issues were found.

Here is where the planning took another turn.

This 19% Mineral/Landowner originally agreed to lease only if we would pay surface damages of twice what you could buy land for ($30,000) and $150 per acre Lease Bonus with only a 3-year term on the Lease (no extensions).

Several attempts to discuss this were made with the 19% Mineral/Landowner and he stopped taking all calls but responded to an email stating that he changed is mind and he was not interested under any terms.

He was unresponsive to all calls for the next 4 months.

NOTE: This Mineral/Landowner owned 19% of the minerals and 100% of the surface and the other 81% Mineral Owner had already leased their ”A” Tracts and had agreed to lease their minerals under these ”C” Tracts for the same terms and the Leases used for the “A” Tracts.

Strategy Moving Forward – Adapting the Lease to the Project

Moving forward at this point, new Leases and Surface Damage and Use Agreements had to be entered in the “B” Tracts first before we could offer a Mineral Only Lease to the 19% Mineral Owner in the ”C” Tracts.

If the Mineral/Landowner in the ”B” Tracts would agree to our Lease or Surface Damage and Use Agreement, then the decision whether or not to lease the 81% Mineral Owner in the “C” Tracts had to be made, knowing that we could go ahead with drilling and carry the 19% Mineral Owner and use the Surface (hostile move).

NOTE: Keep in mind that in addition to drilling on the “B” Tracts we needed the surface access to drill under the “C” Tracts.

We elected to enter a Lease Option with the 81% Mineral Owner (“C” Tracts”) for 90 days in attempt to obtain a Mineral Only Lease from the 19% Mineral/Landowner.

To learn more about with different critical title issues, visit our website at www.InstituteOfEnergyManagement.com. View our course catalog and chose the Concepts of the Oil and Gas Lease.